vehicle tax

Driving & Transport

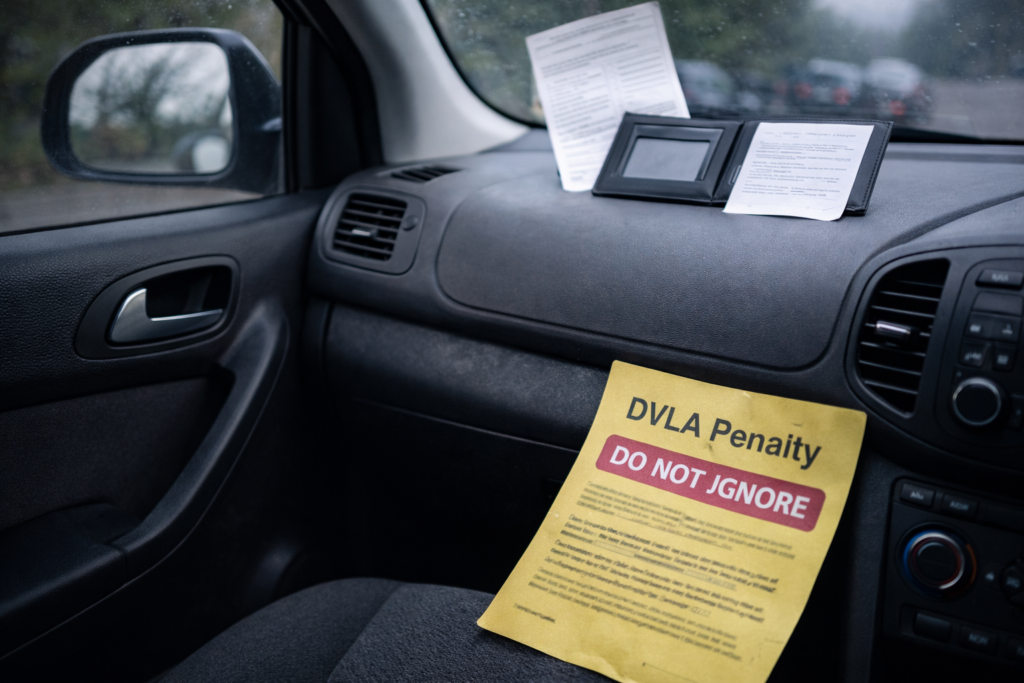

DVLA penalty issued due to admin delay

If a DVLA penalty has been issued because records were updated late, a fast, evidence-led challenge through the official route can stop escalation. This explains what to send, when to chase, and how to escalate if DVLA does not respond.

Driving & Transport

Vehicle tax wrong or duplicated

If vehicle tax looks wrong or has been paid twice, it’s usually a keeper-change or Direct Debit overlap. Use a clear timeline and payment proof to get DVLA records and refunds corrected.

Driving & Transport

DVLA wrong address issue

A DVLA wrong address can lead to missed reminders, late fines and problems selling or taxing a vehicle. These steps help correct both licence and V5C records and handle any knock-on notices.