UK consumer rights

Services & Contracts

Company dissolved during dispute

If a company dissolves while a dispute is ongoing, the practical next steps usually depend on how payment was made and what evidence exists. This explains how to confirm status, use official payment-provider routes, and when to escalate.

Services & Contracts

Digital content refund refused

If a retailer refuses a refund for faulty digital content, a structured complaint and the right evidence usually shifts the decision. This explains what to send, what to keep, and when to escalate in the UK.

Services & Contracts

Warranty invalidated due to technicality

If a company says your warranty is invalid due to a technicality, you can still push for a remedy through the retailer’s UK consumer rights route. This page sets out the evidence to gather and the escalation steps that usually work.

Services & Contracts

Policy terms changed mid-contract

If a provider changes policy terms mid-contract, a focused written complaint and evidence bundle usually gets either the original terms restored or a penalty-free exit. This explains what to gather, how to escalate, and how to avoid avoidable arrears while the dispute runs.

Services & Contracts

Business ignores Letter Before Action

If a business ignores a Letter Before Action, a final chaser and a clear escalation plan usually gets movement. This explains what evidence matters and when to move to the official process.

Services & Contracts

Complaint marked resolved without consent

If a company marks a complaint as resolved without agreement, a short written reopen request and a clear deadline usually gets a proper final response. This page sets out what to send, what evidence matters, and when to escalate.

Services & Contracts

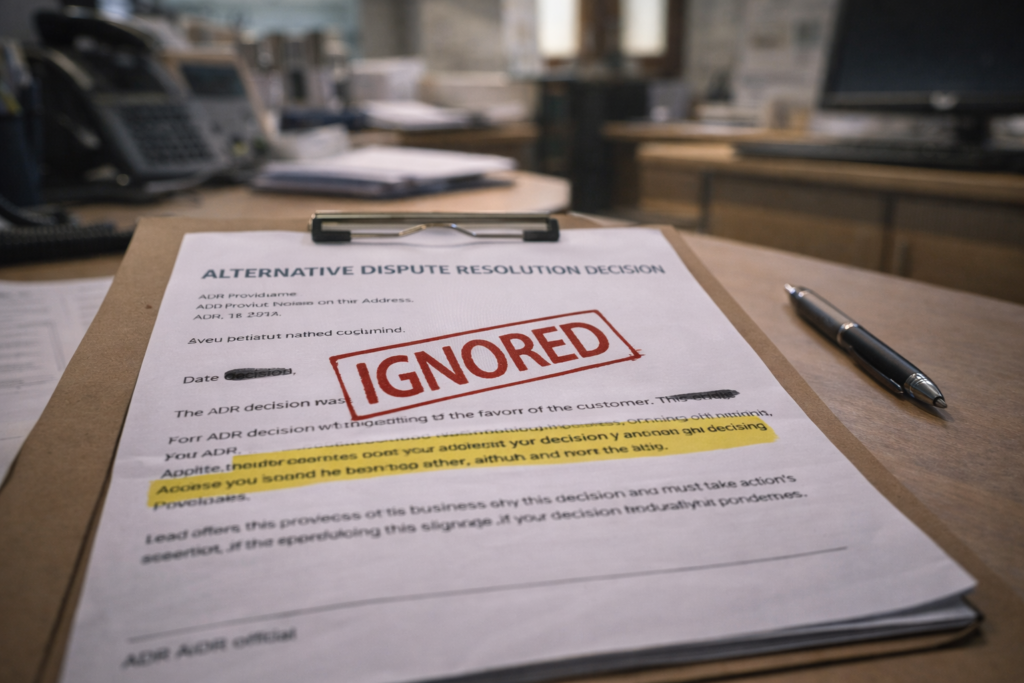

ADR decision ignored by business

If a business ignores an ADR decision, treat it as non-compliance and move to a clear final deadline and enforcement. This explains what evidence matters and when to escalate in the UK.

Money & Legal

Small debt threatening letters explained

Small debt letters from an energy supplier are often automated and can be stopped by opening a formal billing dispute and asking for a collections hold. This explains what to gather, what to send, and when to escalate in the UK.

Money & Legal

Bank refusing chargeback

If your bank refuses to raise a chargeback, treat it as a formal complaint, tighten the evidence bundle, and set a clear deadline for a final response so you can escalate.

Services & Contracts

Insurance excess dispute

If your insurer is demanding the wrong excess, treat it as a formal complaint and ask for a written breakdown tied to your policy schedule. If it isn’t resolved, escalate to the Financial Ombudsman after the insurer’s final response or 8 weeks.