Financial Ombudsman Service

Driving & Transport

Insurance claim rejected due to “non-disclosure”

If an insurer rejects a claim for “non-disclosure”, a focused complaint with the exact question set and a clear timeline often shifts the decision. This explains what to gather, how to complain, and when to escalate in the UK.

Driving & Transport

Insurer cancels policy after claim

If an insurer cancels a policy after a claim, act quickly to avoid a cover gap and force a clear written reason. Use the insurer’s complaints process and escalate properly if the decision stands.

Uncategorized

Breakdown provider refuses refund

If a breakdown provider refuses a refund, a written complaint with a clear deadline usually forces a decision. This page explains what evidence matters and when to escalate in the UK.

Services & Contracts

Bank sides with merchant in chargeback

If a bank rejects a chargeback after siding with the merchant, the next move is a formal complaint backed by targeted rebuttal evidence. This explains what to gather, the UK escalation path, and when to switch strategy.

Services & Contracts

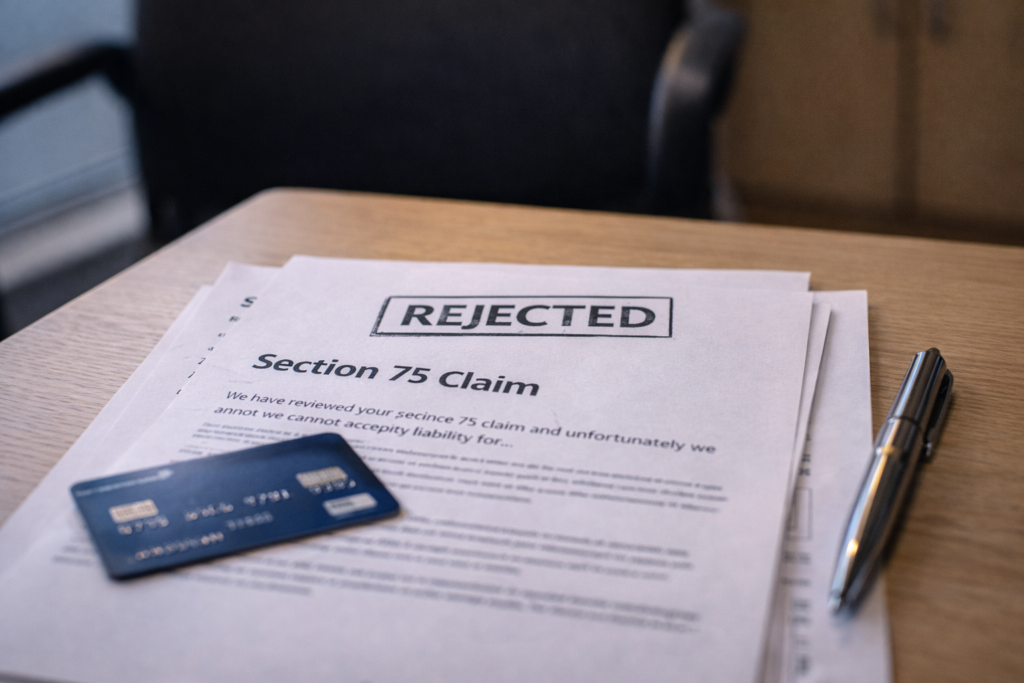

Section 75 claim rejected by lender

If a lender rejects a Section 75 claim, the next move is to force a clear final response and escalate through the proper UK complaint route. This explains what evidence usually changes the decision and when to take it further.

Services & Contracts

Insurance excess applied incorrectly

If an insurer has taken the wrong excess, the quickest route is a written calculation request followed by a formal complaint and escalation if needed. Clear policy pages and a settlement breakdown usually unlock a correction.

Services & Contracts

Insurer reduces payout without explanation

If an insurer reduces a payout without explaining why, a written breakdown request and a formal complaint usually prompts a proper recalculation. If it doesn’t, escalation is often possible once a final response is issued or the complaint timeframe passes.