Ask the insurer for a written breakdown of how the payout was calculated and request a formal review under their complaints process. If nothing is done, the reduced settlement often becomes the figure the insurer treats as final and the claim can drift past key escalation points. Keep communication in writing and set a clear deadline for a proper explanation and recalculation. If the insurer still will not justify the reduction, prepare to escalate with a complete evidence pack.

What the problem is

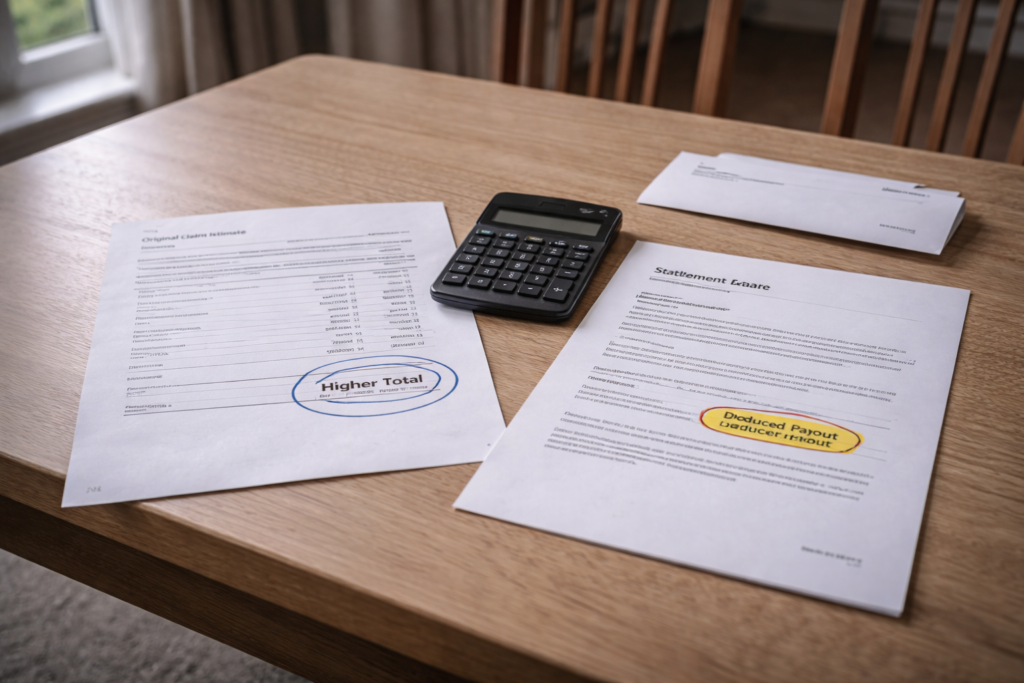

This comes up in UK insurance claims where a settlement offer arrives lower than expected, but the letter or portal update gives little more than a headline figure. It affects motor, home, travel and gadget claims most often, especially where the claim involves valuation, wear and tear, policy limits, excesses, or “betterment” deductions. The issue usually appears after the insurer has accepted the claim in principle, or after a partial response that says the claim is “approved” but the payment does not match what was discussed.

Many people only notice the reduction once the money lands in the bank or when a repairer invoice is not fully covered. It is also common after a long period of silence, where the insurer reappears with a settlement that feels like a take-it-or-leave-it number. By this stage, the insurer’s internal notes and valuation sources matter, but they are not always volunteered unless asked for directly.

Why this happens

Reduced payouts without explanation usually come from a calculation step that is treated as “standard” internally but is not communicated clearly to the customer. Common drivers include applying the policy excess, applying a single-item limit, using a lower market valuation source, deducting for pre-existing damage, applying depreciation, or treating a replacement claim as a cash settlement. Another frequent cause is the insurer relying on a supplier report (engineer, loss adjuster, repair network, valuation tool) and summarising it too aggressively in the customer-facing message.

There is also a commercial incentive to close claims quickly and keep costs predictable, so settlement letters can be templated and light on detail unless challenged. Where the claim handler is working to targets, the “explanation” may be reduced to a short phrase such as “market value” or “policy terms” without showing the working. A typical organisational response pattern is that the first reply repeats the same figure and asks for more documents, rather than addressing the calculation itself.

Sometimes the reduction is not a single decision but a chain of small deductions that add up, and the insurer may assume the customer will not contest each step. When challenged with specific questions, insurers often can produce a clearer breakdown, but only after the complaint is logged and routed to a team with authority to revisit the valuation.

Your UK position

In UK cases, the most effective leverage is to require the insurer to show the basis for the figure and to point out any mismatch between what was claimed and what was assessed. A calm request for the calculation, the valuation source, and the policy term relied on usually gets further than arguing about fairness in general terms. If the insurer cannot explain the reduction clearly, that weakness tends to carry through any later escalation.

It also helps to separate “liability/coverage” from “quantum/valuation”. Even where the insurer is right to apply an excess or a limit, the customer can still challenge the valuation method, the condition assumptions, or whether the insurer used the correct item description. Where repairs are involved, asking whether the insurer is offering indemnity (putting things back to the prior position) or a cash alternative often exposes the reason for the shortfall.

Practical pressure points include the insurer’s own complaint deadlines, the need for them to issue a final response, and the reputational and administrative cost of an external review. Clear, dated questions and a request for a final response if they will not change the figure tends to move the file out of “ongoing handling” and into a decision track.

Official basis in UK

The Financial Ombudsman Service route is the main official backstop for most personal insurance disputes about settlement amounts and complaint handling. In practice, the insurer must be given a chance to resolve the complaint first, and then a case can be taken to the Ombudsman if the insurer issues a final response or if the complaint has not been resolved within the usual complaint timeframe. The Ombudsman typically looks at what is fair and reasonable in the circumstances, including whether the insurer explained the settlement properly and used a defensible valuation method, rather than relying on vague references to “policy terms”.

Use the Ombudsman’s complaints information to align the complaint wording and to understand what the insurer should provide as part of a proper response: GOV.UK guidance.

Evidence that matters

Evidence is strongest when it shows the insurer’s figure is based on an incorrect assumption, an incomplete item list, or a valuation that does not match the real market for the same condition and specification. For motor claims, that means the exact trim/spec, mileage, optional extras, service history, and pre-incident condition. For home contents, it means proof of purchase, model numbers, age, and what a like-for-like replacement costs from mainstream UK retailers.

Collect the insurer’s communications too, including portal screenshots, settlement letters, and any engineer or loss adjuster summaries. If the insurer mentioned a valuation source, ask for the comparable examples used and the adjustments applied. If the insurer did not mention a source, that absence is part of the complaint: the request is for the working, not just the outcome.

What not to do is accept the payment as “full and final” yet, even if the money has already been received, because that can be treated as agreement in some complaint workflows. One thing not to do yet is commission paid-for expert reports unless the insurer has confirmed they will consider them or the dispute is clearly at the escalation stage.

Key documents

Keep the pack tight and readable so the complaint handler can follow the numbers without guessing.

- Settlement letter or payment advice showing the reduced figure

- Claimed item list or repair estimate with dates and amounts

- Photos and condition notes from before the loss (where available)

- Comparable prices for like-for-like items or vehicles in the UK market

- Any engineer/loss adjuster notes the insurer has already shared

Common mistakes

These are the errors that most often slow down a recalculation request or lead to a flat refusal.

- Arguing only that the figure “feels low” without challenging a specific assumption or deduction

- Sending dozens of links and screenshots without a short summary of what each proves

- Accepting a repairer’s verbal view as evidence without a written estimate or invoice

What to do next

Ask for breakdown

Reply in writing and request a full breakdown of the settlement calculation, including each deduction and the reason for it. Ask which valuation source was used, what comparables were selected, and what adjustments were applied for condition, age, mileage, or specification. Set a clear deadline for a written response and state that the complaint should be logged if they cannot provide the breakdown promptly.

Start formal complaint

Use the insurer’s official complaints process (usually found on the insurer’s website under “Complaints” or in the policy documents) and keep the complaint focused on the unexplained reduction and the specific points to correct. Do not invent form fields or send unnecessary personal data; use the insurer’s own online form, email address, or postal route as they specify. Prepare the complaint so it can be understood without a phone call: what was claimed, what was offered, what is missing, and what evidence supports the corrected figure.

Control the timeline

Ask the insurer to confirm when a complaint handler will respond and when a final response will be issued if the dispute is not resolved. If the insurer tries to close the complaint without addressing the calculation, treat that as a process issue as well as a valuation issue; the same pattern often appears in situations like Complaint marked resolved without consent, where the file is closed before the core point is answered.

Escalate after silence

If there is no meaningful response, or the reply repeats the figure without showing the working, ask for the insurer’s final response so the matter can be escalated externally. The normal response timeframe for an insurer complaint is within eight weeks, and many UK cases are resolved when the insurer realises the customer has a clean evidence pack and is tracking dates. If the insurer issues a final response that still does not explain the reduction, escalate to the Financial Ombudsman Service using the insurer’s final response letter and the evidence pack already prepared.

Prepare essentials

- Policy number and claim reference

- The settlement figure offered and the figure being requested

- A one-page summary of disputed deductions or assumptions

- Copies of key evidence (not everything available)

- Dates of contact and any missed promises to call back or update

A typical UK outcome is that the insurer revises the offer after a formal complaint forces a clearer valuation review.

Related issues on this site

If the reduced payout is tied to a policy being extended or altered without clear agreement, the steps in Subscription renewal without consent can help when the dispute is really about what cover was in place at the time. If the insurer says the customer must mediate and then backs away from that route, the pattern in “company requests mediation then withdraws” is usually relevant when deciding whether to keep negotiating or move straight to a final response and escalation.

FAQ

Valuation sources

For car insurance settlement valuation sources, ask which database or comparables were used and what adjustments were applied. If they cannot show the working, request a complaint review.

Excess applied

For insurance payout reduced by excess, check whether the excess was already accounted for in any earlier figures or repair authorisations. Ask for the calculation line that shows it.

Betterment deduction

For betterment deduction on insurance claim, ask what part was treated as an improvement and why a like-for-like repair was not possible. Request the insurer’s written rationale and any engineer notes.

Partial payment

For accepting a partial settlement payment, confirm in writing that it is accepted only as an interim amount while the complaint is reviewed. Avoid wording that agrees it is full and final.

Before you move on

Write down the exact figure being challenged, the specific deductions to correct, and the date the complaint was first raised, then keep everything in one thread so deadlines are easy to prove. This situation often involves time pressure from being pushed to accept quickly.

Get help with the next step

Contact UKFixGuide — Share the insurer’s settlement wording and the missing breakdown points so the next message can request the calculation clearly and set escalation dates.